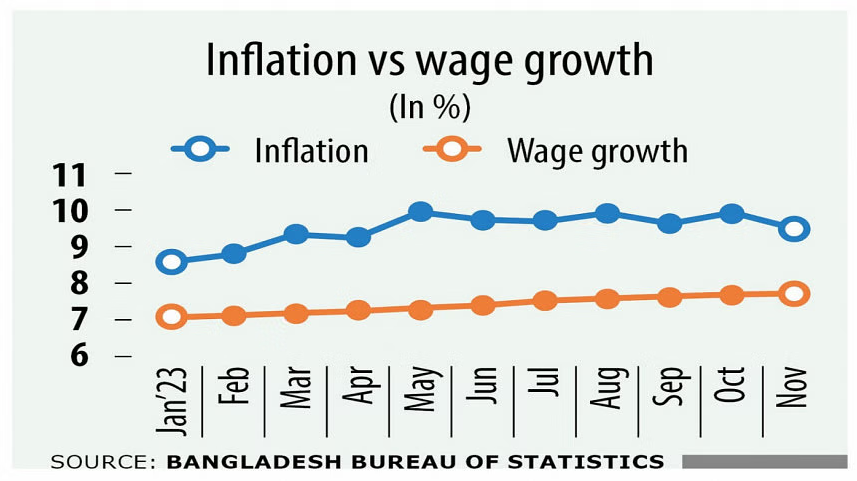

Average wage growth remained well below the inflation rate in Bangladesh for the 22nd month straight, as per the Bangladesh Bureau of Statistics (BBS), indicating a worsening situation and compelling many to cut consumption amid falling real income.

In November, wages of low and unskilled workers grew 7.72 percent year-on-year, which was 1.77 percentage points below the inflation rate of 9.49 percent that month, showed the Wage Rate Index (WRI) of the BBS.

It was a similar case in October, when the wages of workers across 44 occupations in agriculture, industry and services grew at 7.69 percent, which was 2.24 percentage points below the inflation rate at the time.

Analysts say the widening gap between the inflation rate and wage growth is forcing low-income and unskilled workers to cut consumption amid falling real incomes and rising cost of living.

The overall wage rate for workers in the agriculture sector increased but in sub-sectors such as fishing, the wage growth slowed to 8.14 percent from 8.17 percent.

Division-wise, wage growth in Dhaka, Chattogram, Sylhet, Mymensingh and Khulna rose. On the other hand, it decreased in Rajshahi, Rangpur and Barishal.

“This is a reflection of the ongoing economic crisis,” said Prof Selim Raihan, executive director of the South Asian Network on Economic Modeling, a think-tank.

The trend indicates that the real income of the people is consistently being eroded as wage growth has remained below inflation, he said.

This means that people can buy less, and many are forced to exhaust their savings and other options against the backdrop of high inflation.

“People are not getting the right solution to escape this situation,” he added.

Raihan, also a professor of economics at the University of Dhaka, said the country’s economy had lost its dynamism as major indicators, such as private investment growth, LC openings, and credit growth, had slowed.

Raihan said costs of living would balloon further if the situation could not be reversed.

“The poor are always losing out in terms of prices as their real incomes have been lagging behind the prices of goods and services for a long time,” said Prof MM Akash, chairman of Dhaka University’s Bureau of Economic Research.

This implies that consumers are suffering from a loss of real consumption. They are working much harder but consume less.

According to the Labour Force Survey (LFS) 2022, of the 7 crore employed individuals in the country, around 85 percent, or around 6 crore, work in the informal sector. Of total informal workers, around 88 percent are based in rural areas.

“Those who are working in the informal sectors as casual labour are the real sufferers as they do not have employment opportunities to compensate for their consumption loss,” Akash said, stressing that job creation initiatives should be increased.

They are probably adjusting their consumption of nutritious food due to lack of employment opportunities, he said, adding: “It is now creating health risks.”

About the way out of the situation, he opined that bringing informal workers into formal channels may raise their absolute wages.

Over the years, the share of informal employment has not declined much. It was estimated to be 87.5 per cent in 2010.

However, the urban poor are the most vulnerable to higher inflation as they do not get sufficient social safety net facilities like those in rural areas, according to Akash.

In this circumstance, the government should expand coverage and allocation of social protection schemes to prevent them from falling into deeper impoverishment, Raihan added.

In the first months of fiscal 2023-24, public food distribution rose more than 23 percent year-on-year.

Data from the food ministry showed that 12.92 lakh tonnes of rice and wheat were distributed under various schemes such as Open Market Sales (OMS) and the Food-Friendly Programme as of November 23 of the current financial year. It was 10.50 lakh tonnes during the same period in fiscal 2022-23.

However, noted economist Muinul Islam believed the measures adopted to tackle inflation and the safety net programmes were not providing enough to those from low-income groups.

“The government is not doing enough. Their role is disappointing,” he said.

Islam, a former professor at Chittagong University, said the inflation rate was still higher in Bangladesh compared to other South Asian nations.

The government should take necessary steps to rein in inflation as well as expand social safety net programmes, Islam suggested.

SOURCE: CLICK HERE