Bangladeshi apparel entrepreneurs said the potential influx of additional orders to Bangladesh would not only catalyse the growth of existing industries but also pave the way for the creation of numerous job opportunities.

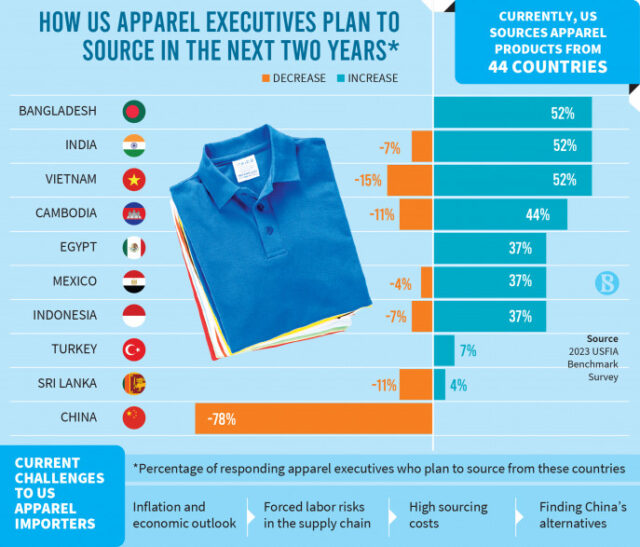

When queried about the countries or regions from which US fashion companies intend to enhance their sourcing value over the next two years, an equal proportion (52%) of executives intend to boost their sourcing from Vietnam and India alongside Bangladesh.

However, 15% of US fashion executives expressed a desire to reduce their sourcing from Vietnam, while 11% aimed to do so from Cambodia and Sri Lanka. Additionally, 7% indicated a similar intention regarding India and Indonesia.

In contrast, a significant 78% stated their intention to reduce sourcing from China, with no executives indicating an alternative stance.

None of the executives interviewed expressed a desire to reduce their sourcing from the country, as per the study, which was published recently.

According to sources, in 2022 the US imported apparel products worth more than $10 billion from Bangladesh.

Mohammad Hatem, executive president of the Bangladesh Knitwear Manufacturers and Exporters Association (BKMEA), said a majority of brands and buyers are reluctant to engage in sourcing from China primarily due to geopolitical concerns.Bangladesh’s global market share in clothing exports rises to 7.9%

These geopolitical factors have introduced a sense of uncertainty among all buyers, prompting them to explore alternative sourcing destinations, he said.

He added, “China holds the title of being the world’s largest exporter of apparel. Should a 2%-3% market share from China be redirected, no other country possesses the capability to step in and bridge this gap, except for Bangladesh.”

He underscored the fact that Bangladesh’s apparel industry has established itself as a dependable and steadfast supplier within the global market.

Besides, the consistent political stability in Bangladesh experienced in recent years has contributed to the industry’s growth, positioning it for a significant surge in exports, he said.

Shahidullah Azim, vice president of the Bangladesh Garment Manufacturers & Exporters Association (BGMEA), said a notable trend among western buyers is that they are searching for an alternative to China for apparel sourcing.

“In this context, Bangladesh holds a distinct advantage due to its robust capacity, commitment to ethical manufacturing practices, and emphasis on sustainable, environmentally friendly industries,” he said.

According to entrepreneurs, Bangladesh must focus on enhancing its infrastructure capacity to effectively address future demands, with particular emphasis on bolstering port and road communication capabilities.

The industry has set a goal of achieving a substantial $100 billion in apparel exports by the year 2030, they said.

BKMEA Executive President Mohammad Hatem said that there are boundless opportunities for expanding the apparel market share even further.

However, he acknowledged that the challenge of maintaining an uninterrupted supply of utilities – such as gas and electricity – remains a hurdle to achieving continued growth.

US apparel industry’s anti-China strategy

According to the study, US apparel companies are fast-tracking efforts to diminish their reliance on China due to escalating bilateral concerns.

A major challenge in 2023 is diversifying sourcing bases beyond China. Notably, over 40% now acquire under 10% of apparel from China, up from 30% a year earlier. A record 61% shifted from China as their top supplier, compared to 50%, the study revealed.

The sourcing model transitions from “China plus Vietnam plus many” to “Asia plus rest of the world,” with 97% sourcing at least 40% from non-Chinese Asian nations.

Yet, reducing “China exposure” in textile raw materials remains tough due to limited alternatives for 70% sourcing yarns, fabrics, and accessories, as per the study.

Sustainability Issues in Sourcing

In the study, US apparel executives demonstrate a solid dedication to expanding their sourcing of clothing made from recycled or other sustainable textile fibres.

Around 90% of the respondent executives of this study plan to allocate more resources towards sustainability and compliance over the next two years, notably higher than approximately 60% reported before the pandemic.

In the study, respondents seem keen on adopting sustainable textile and apparel items as over 80% plan increased allocation for recycled or sustainable textile materials.

The study also underscores tariff reduction or elimination on such imports as a key trade policy proposal.

The United States Fashion Industry Association (USFIA) produces the Fashion Industry Benchmarking Study every year.

SOURCE: CLICK HERE