Exporters have said that they are facing challenges in adjusting their additional production costs due to gas and electricity price hikes within the country. Additionally, the price hikes of locally sourced raw materials have affected businesses dealing in jute products and frozen and live fish, they added.

Data from the Export Promotion Bureau (EPB) show that Bangladesh’s merchandise exports grew by 8.07% to $41.72 billion year-on-year in the July-March period of this fiscal year. However, this growth was primarily due to the readymade garments sector, which saw a 12.17% growth to $38.25 billion in the period.

In March this year, the country’s overall exports fell by 2.41% to $4.76 billion, but it was cushioned by the garments sector, which has been a dependable saviour for Bangladesh’s export economy.

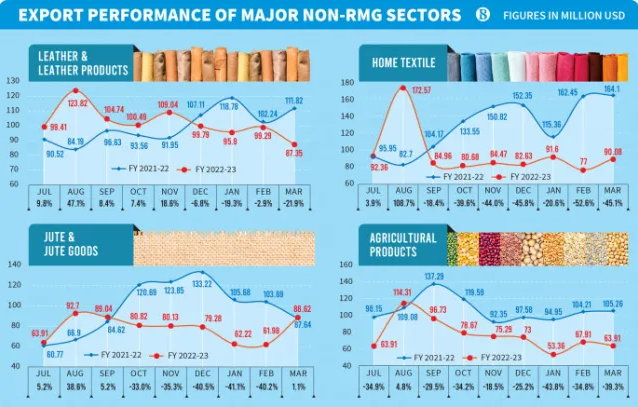

All major export sectors, apart from the RMG and leather sectors, registered negative growth in the first nine months of the current fiscal year. For instance, exports of home textiles fell by 25.73%, jute and jute goods by 21.23%, agricultural products by 28.31%, and engineering products by 33.65%.

Exports of leather and leather products, however, grew by 2.56%.

Mohammad Ali Khokon, president of the Bangladesh Textile Mills Association (BTMA), told The Business Standard that the global economic downturn has led to the closure of a number of home textile stores in major markets, which has affected Bangladesh’s exports.

He added that home textiles are the third option of consumers in apparel, and none of them will buy new ones until the economic situation improves.

Joseph Chowdhury, business head of Momtex Expo Ltd, observed that war-driven high inflation has impacted business, as people are not buying home textiles.

Due to the lack of customers, many stores in the EU have already closed, and Bangladesh is not getting orders as it did in previous years, making 2023 a very tough year, he said.

Meanwhile, the recent gas price hike has increased cost for the firm by 5%-8%, and during low orders in the market, it is unable to offer any customers an increase in price.

Pakistan is one of the major competitors in the home textiles segment, with an advantage of offering about 30% less than Bangladeshi exporters due to currency devaluation, Joseph noted, adding that Bangladeshi exporters are losing their competitiveness due to the recent gas price hikes.

Momtex Expo Ltd has seen about a 50% sales drop in the last couple of months, with a capacity of producing three million meters a month, he told TBS.

A leading home textile exporter, who wished to remain anonymous, said that customers have lost their purchasing power due to energy price hikes in the global market.

The market might not improve until the energy market stabilises, he observed, adding, “None of the customers will break free of fear until the global inflation situation improves.”

Jute and jute goods

The once prosperous jute industry, which crossed the billion-dollar export mark in the last fiscal year, has experienced a significant decline in earnings, with a slip of over 21% year-on-year in the first three quarters of this fiscal year.

Sheikh Nasir Uddin, chairman of Akij Group – one of the largest jute goods exporters in the country – has attributed this drop in earnings to the high prices of raw materials.

Further explaining the situation, he said last year a group of illegal stockists drove up the prices of raw jute, which usually ranged between Tk2,000 to Tk2,500, to as high as Tk6,000 per maund (one maund is about 37kg).

As a result of this syndication, a number of importers in Turkey have switched to using recycled clothing yarn instead of jute yarn for the lower parts of their carpets, which has affected the Bangladeshi jute yarn market since Turkey is its largest market.

However, Sheikh Nasir Uddin stated that negotiations are still ongoing to improve business, and exporters are working on diversifying their products and markets.

Although there has been some growth in the business in March this year, he emphasised the need for a stable price of raw materials to do business in the international market.

Leather and leather products

Despite some growth in the leather goods and footwear sector in the first nine months, leather exports experienced negative growth of about 20%, while leather footwear dropped by about 1%. However, the sector shortfall has been recovered by the growth of leather products exports year on year.

Syed Nasim Manzur, president of the Leathergoods and Footwear Manufacturers and Exporters Association of Bangladesh, stated that the sector was in good shape until December 2022, as orders were booked five to six months before, and in some cases, even earlier.

However, since January, the sector could predict that exports might decrease due to non-essential purchases and high inflation caused by the Ukraine war. The Covid pandemic has also changed customers’ buying patterns, as they are spending more in restaurants and less on products.

The US market, which imported a record amount of leather goods from Bangladesh last year, has huge inventory but is witnessing a drop in sales due to high inflation and interest rates. As a result, many retailers are waiting to clear their inventory before placing new orders, said Syed Nasim Manzur, who is also managing director of Apex Footwear Ltd.

Despite economic uncertainty, the Japanese market has been performing well, he said.

According to chartr.co, Nike and Adidas have mountains of unsold inventory. Of them, Nike reported that sales were up 14% to $12.3 billion in its most recent quarter, but the company continues to carry a near-record level of stock, with inventory up 53% in the last 3 years.

Adidas is having a harder time with its own inventory issues, warning that 2023 could see the German company’s first annual loss in three decades.

By next June, the sector may enjoy slight positive corrections in business growth, said Nasim Manzur. But he acknowledged that the sector is currently facing a “perfect storm” of challenges.

Ibnul Wara, managing director of Austan Ltd, a Dhaka EPZ-based export-oriented finished leather manufacturer, suggested that the sector could improve by ensuring environmental compliance in tanneries and attracting foreign investment.

In the long run, he also recommended reducing dependence on the European market to minimize risks. Ibnul Wara also said the Japanese, Australian and Canadian markets have huge potential to grow.

Frozen and live fish export

Shrimps are the major export earner in the frozen and live fish category but due to global inflation, their exports saw about a 25% YoY drop in the first three quarters of the current fiscal year.

Kazi Belayet Hossain, president of the Bangladesh Frozen Foods Exporters Association, said shrimps are always treated as luxury food items. Due to high inflation buyers are not placing new orders, and in some cases, are deferring their orders.

This business may not return to a positive trend until the economic situation improves, he added.

The industry did not face such hard times even during Covid, said Kazi Belayet Hossain, who serves as managing director of Sobi Fish Processing Industries Ltd.

Exporters mentioned that shrimp cultivation has dropped over the years and the increasing buying capacity of local people is also squeezing raw materials sourcing.

Agricultural products

Agro-product exports crossed the $1 billion mark in both FY21 and FY22, thanks to increased consumption of processed food with consumers holed up at home globally during the pandemic.

But in the first three quarters of the current fiscal year, the sector’s export receipts fell by over 28% to $687.09 million, which was $958.45 million in the same period of the last fiscal.

Kamruzzaman Kamal, director of PRAN-RFL Group, said, “As a company, we are in a good position though the overall industry is not in good shape and growth is not as per our expectations.”

Bangladeshi agro-product exporters are losing their competitiveness in the global market due to some internal factors, he added. Besides, amid the global economic slowdown, buyers are more cautious about spending, which has also impacted their consumption, he concluded.

Bicycles

Bicycle exports fell by 9.13% to $111.14 million in the first three quarters of the current fiscal year from $122.31 million in the corresponding period a year ago.

“Bicycle export business is going through a worse phase even when compared to the Covid times,” said Md Lutful Bari, operations director of Meghna Group – the bicycle export leader in the country.

Gas supply shortage and its price hike also dealt a blow to bicycle exporters, added Bari, who is also the secretary general of the Bangladesh Bicycle and Parts Manufacturer and Exporters Association.

SOURCE – CLICK HERE