Industry stakeholders say the United States’ anti-China position may have also played a role in Bangladesh’s shift towards India for man-made fibre, the import volume of which is likely to double in the next five years from the neighbouring ally.

Businesses said the move towards alternative sources for raw materials will help support the growth of the man-made fibre industry in Bangladesh and reduce dependence on China.

Last December, the Bangladesh government allowed the import of man-made yarn and fabric through Benapole and two other new land ports – Bhomra in Satkhira and Sonamasjid in Chapainawabganj.

Last month, 60 firms of Gujarat yarn and fabric producers, most of whom are involved in the man-made fibre trade, participated in an expo in Dhaka to explore the possibility of exporting the product at a higher rate to Bangladesh.

A delegation of the Bangladesh Garment Manufacturers and Exporters Association (BGMEA), led by its President Faruque Hassan, is visiting India on Wednesday to explore the possibility of sourcing man-made yarn from the neighbour.

“Gujarat has a special reputation for man-made fibre yarns and fabrics. Bangladesh has also increased its focus on the export of such products. As a result, we have increased attention there for raw materials, which will help us reduce our dependence on China,” the BGMEA president said.

“Opening of the new land ports will help reduce lead time in the import of yarn and fabric. We want to import this type of yarn and fabric from India, develop designs and export clothes to western countries. There is an opportunity to increase exports to India as well,” he said.

The global market for man-made fibre clothing is steadily increasing while demand for cotton made clothing is decreasing. However, for Bangladesh it is the other way around. – man-made fibre clothes cost more than cotton.

Sparrow Group, one of the largest RMG exporters in Bangladesh, mostly manufactures high value-added apparel, has been increasing their raw material import from India.

“Previously, I used to import almost all of my requirements from China. Last year we imported 20% of the raw materials from India. In particular, we have increased the import of raw materials for export to the US market from there. In addition to lead time, quality and price are also competitive,” Shovon Islam, managing director of the company that makes more than $200 million annual exports, told The Business Standard.

He expressed hope that import will increase with the opening of new ports for the import of these raw materials and the approval of partial shipment (the delivery of consignment in more than one shipment) for yarn.

Fazlee Shamim Ehsan, chief executive officer of Narayanganj-based Fatullah Fashion Limited, said his company has imported polyester fabric from India for its sportswear, which was earlier imported from China.

“It is not always the price that benefits are available. There will be benefits in the lead time. Besides, a new window has opened and made imports easier,” he said.

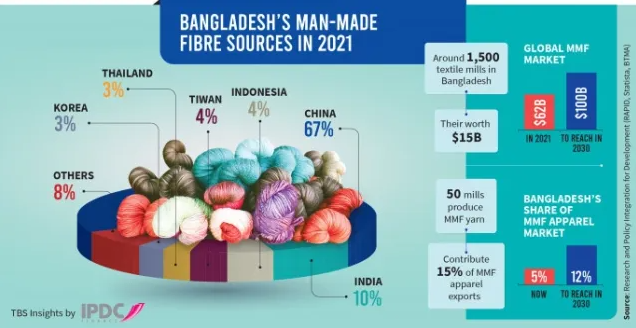

The global apparel market was $440 billion in 2021, of which man-made fibre apparel accounted for more than 50%. On the other hand, Bangladesh’s cotton based apparel export accounted for 72%, man-made fibre apparel 24% and the rest were silk, wool and others.

According to the research report of Research and Policy Integration for Development (RAPID), the apparel market of man-made fibre will continue to grow larger than that of cotton in the coming years.

According to the report, local textile mills contributed only 15% of Bangladesh’s total man-made fibre garment exports in 2021. About 70% of the remaining imported raw materials come from China while 10% is imported from India.

BGMEA Vice President Shahidullah Azim feels that imports from India are likely to double in five years. However, he emphasised on increasing local capacity.

M A Razzaque, chairman of RAPID, told The Business Standard, “There may be more restrictions on China at any time due to geopolitical reasons. So sourcing from other countries is increasing as part of reducing dependency on China. If Bangladesh benefits from India, imports from there may increase.”

However, buyers have a role to play in sourcing raw materials. In this regard, he said, “Many brands do not want to have more than 50% of their sourcing dependency on one country. That’s why many people are moving out of China.”

However, he advised increased investment in man-made fibre raw material in the country to reduce import dependency.

Local textile mills contribute only 15%

While local textile mills supply about 65% of Bangladesh’s cotton-based garments, according to RAPID’s calculations, man-made fibres account for 15%. However, BGMEA vice-president Shahidullah Azim feels that this share will be less than that.

In the past, many people did not want to invest in this sector due to low demand from local garment entrepreneurs and buyers and the huge investment involved. However, as the demand is increasing day by day, many have come forward to invest in the last two years and around 50 factories are more or less manufacturing the raw material of these garments.

Noman Group, Envoy Group, DBL Group, Maksons Group, Square Group and Shasha Denim are now setting up new facilities for manufacturing synthetic and blended yarns. Some of these have also gone into production.

Kutubuddin Ahmed, chairman of Envoy Group told The Business Standard “Our factory is going to produce blended yarn (mixture of cotton and manmade fibre yarn) from next month. Production will be around 30 metric tonnes per day.”

Pointing out the reasons behind the investment not increasing according to demand, he said that at one time the demand was low. Later, as the price of cotton increased, so did the demand for man-made fibre garments, which started drawing investments.

Indian exporters are gauge potential

Some 60 companies from India’s Gujarat showcased their yarns and fabrics at an exhibition titled Indian Textile and Trade Fair (ITTF), which was held in Dhaka in January.

Most of these companies exhibited specialised fabrics including man-made fibres and blended yarns, which are made into various types of women dresses, bridal dresses, gowns, sarees, kids dresses. Garments made of these yarns and fabrics are relatively high priced.

Sanjay Gadiya of Khushi Fabrics, from Gujrat told The Business Standard, “Currently we are exporting to Bangladesh through a third party in Kolkata – amounting to $6 million a year. Hopefully the demand for this product will grow further in Bangladesh.”

Several other Indian companies that took part in the exhibition also spoke about the possibility of increasing exports to Bangladesh in the coming days.

Source: CLICK HERE