Bangladesh has been enjoying significant investment in the primary textile and readymade garment (RMG) sectors in recent years, thanks to tremendous export growth, which has attracted the attention of global capital machinery suppliers.

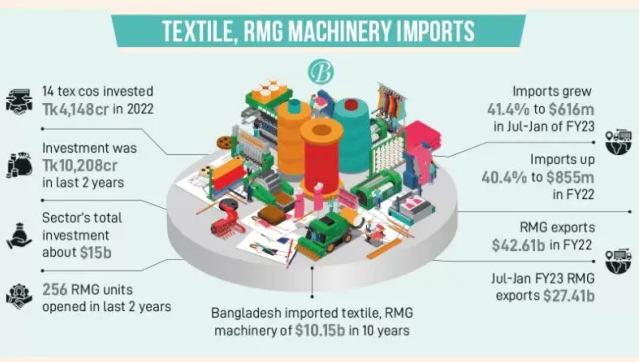

The Bangladesh Bank data shows the country saw 41.4 per cent growth in capital machinery imports in the first seven months of FY23 year-on-year, with the amount reaching $618 million.

The FY22 import growth was 40.4 per cent year-on-year, with the figure rising to $855 million from $609 million in the previous fiscal year. Besides, the textile and RMG sectors imported $10.15 billion of capital machinery between FY13 and FY22.

This growth means Bangladesh could be the top destination for global machinery suppliers as the country is the world’s second largest RMG exporter after China.

Textile and RMG manufacturers as well as global machinery suppliers said the apparel sector is going to witness rapid earnings growth and even more investment. This will happen as brands are shifting from China due to its trade war with the Western allies and Bangladesh’s initiatives in manmade fibre-based cloth manufacturing.

Shima Seiki, a Hong Kong-based machinery company, supplied around 20,000 units of machinery to 200 Bangladeshi factories over the last seven years. Its Chief Executive Officer Ikuto Umeda told The Business Post, “Of course, Bangladesh is the number one destination of my products as sales are increasing amid high demand.”

Thomas Streicher, area sales and product manager of German machinery company Trützschler, said his firm mainly supplies spinning machines.

So far, the company has supplied 600 machines to customers in Bangladesh. Thomas is very optimistic that the Bangladesh market will grow a lot in future.

“Bangladesh is one of the markets with the highest potential for machinery supply as international apparel retailers and brands are sourcing a lot from here. Also, the country has the advantage of a competitive labour force,” he said.

Huge investment in RMG, textile

After the 2013 Rana Plaza collapse, Bangladesh found itself in a very difficult situation as concerns were growing about workplace safety in the textile and RMG sectors. That is why the sector players invested millions of USD to improve workplace safety.

Thanks to that initiative, especially green ones, Bangladesh managed to achieve a good reputation among global brands. This fuelled tremendous apparel export growth, which encouraged investors to put in money in the sectors.

Even despite the Covid-19 pandemic and the Russia-Ukraine war, Bangladesh’s apparel sector was able to retain growth and investment.

According to the Export Promotion Bureau, the country earned $42.61 billion in FY22 from apparel exports, posting a 35.47 per cent year-on-year growth. The sector also earned $27.41 billion in the first seven months of FY23 with a 14.31 per cent year-on-year growth.

The Bangladesh Textile Mills Association (BTMA) data shows the primary textile sector bagged investments of Tk 6,060 crore and Tk 4,148 crore in 2021 and 2022 respectively.

On the other hand, the Bangladesh Garment Manufacturers and Exporters Association (BGMEA) data shows the apex body approved 79 new members in 2021 and 177 in 2022.

Its acting president Shahidullah Azim said the apparel sector received investments of nearly $1.5 billion in the last two years. He added that not only new entrepreneurs but also the existing manufacturers are expanding their capacity.

BTMA President Mohammad Ali Khokon said, “If the government ensures uninterrupted power and energy supply, we will be able to get even more investment. However, more investment is already in the pipeline.”

Capital machinery market size

The country’s apparel export earnings are growing, and the BGMEA expects the annual figure will rise to $100 billion in 2030. That is why

massive investment will come in the primary textile and apparel sectors as investors will want to cash in on the export growth, said stakeholders.

Besides, the RMG sector is still importing nearly $12 billion of fabrics annually, which is increasing the average lead time by 25 days compared to Bangladesh’s competitors. That is why local and foreign investors are investing in the primary textile sector.

The central bank data shows capital machinery imports were $39.23 billion between FY13 and FY22, with the textile and RMG sectors accounting for $10.15 billion. This means the sectors annually imported $1 billion of capital machinery on average.

During this 10-year period, the textile sector imported $4.44 billion of machinery while it was $5.71 billion for the RMG sector.

The data shows from FY16 to FY19, the sectors imported over $1 billion of capital machinery every year. The figure was $1.61 billion in FY18, which was the highest during the 10 years.

But machinery imports declined between FY20 and FY22, with the last fiscal year seeing the highest imports amounting to $855 million. Machinery import is rising in the current fiscal year due to more automation and huge investment.

The banking regulator’s data shows in the first seven months of FY23, the textile sector imported nearly $300 million of capital machinery while it was $318 million for the RMG sector.

BTMA’s Khokon said, “Within the next three fiscal years, a big amount of investment will be made, especially in manmade fibre, which will create a big demand for capital machinery.”

BGMEA President Faruque Hassan said, “Our existing factories are also adopting new technologies, which means suppliers have more opportunities here.”

Meanwhile, Akai Lin, overseas director of Taiwan-based Chan Chao International Co, said the demand for manmade fibre machinery is growing in Bangladesh as entrepreneurs are investing a lot of money to grab more market share.

SOURCE – CLICK HERE