Bangladesh’s exports to Asian markets are growing steadily thanks to increasing demand from several major markets but the country needs to sign trade pacts and diversify products in a continent where the consumer class is fast expanding.

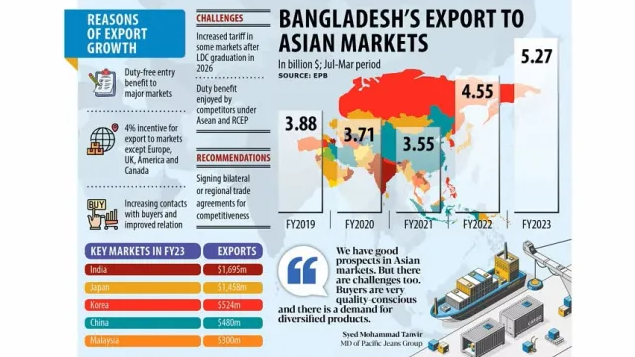

Between July and March of the current financial year, exporters shipped $5.26 billion worth of goods to Asian countries, an increase of 16 per cent from $4.54 billion recorded in the previous year.

The shipment growth in the Asian market doubled the overall 8 per cent expansion seen in national exports in 2022-23, data from the Export Promotion Bureau (EPB) showed.

Thanks to the growth, the share of Asian markets to the country’s overall export receipts of around $42 billion grew to 13 per cent in the current financial year from 12 per cent a year ago.

Exports to the continent started falling in 2019-20 largely owing to the impacts of the coronavirus pandemic. The disappointing sales continued in the following year as the health crisis dragged before reversing the trend in 2021-22.

Two exporters linked the buoyancy to duty-free entry benefits, the government’s 4 per cent incentive aimed at encouraging exports to markets other than Europe and North America, and the increased confidence and business relations between exporters and importers.

“We have good prospects in Asian markets. But there are challenges too. Buyers are very quality-conscious and there is a demand for diversified products,” said Syed Mohammad Tanvir, managing director of Pacific Jeans Group, one of the largest and fastest-growing garment exporters in Bangladesh.

India has emerged as the biggest export market for Bangladesh in Asia, followed by Japan, South Korea, China and Malaysia. The five markets accounted for four-fifths of the export receipts from Asian nations.

Of the destinations, exports grew fast in South Korea, India, Malaysia and Japan in terms of value and percentage. The shipment to Korea surged 78 per cent and to India 70 per cent in the five years to 2022-23.

In Malaysia, export rose 45 per cent since 2018-19 while the extent of growth was 35 per cent in Japan. The only exception is China where earnings registered a 26 per cent plunge.

Md Fazlul Hoque, a former president of the Bangladesh Knitwear Manufacturers and Exporters Association, thinks Bangladesh’s familiarity in the Asian markets is growing.

“Once Indian buyers were not eager to buy from us. There was also a lack of enthusiasm among our exporters too due to payments issue.”

“Our understanding with the buyers in those countries is deepening, so the business is expanding. Mutual reliance among us is going up as well,” said Hoque, also the managing director of Plummy Fashions Ltd, one of the greenest knitwear makers in the world.

Bangladesh fetched 11 per cent higher export receipts of $1.69 billion from India in July-March. It was $1.53 billion in the same period a year ago.

Of the sum, earnings from apparel shipment were $830 million, up 58 per cent year-on-year, data compiled by the Bangladesh Garment Manufacturers and Exporters Association showed. The rest of the earnings came from the sales of non-garment items.

Japan, the second-biggest export destination for Bangladesh, bought $1.45 billion worth of products from the country in the first three quarters of FY23, an increase of 40 per cent from $1.04 billion a year ago.

“These are good markets and the duty-free entry has boosted the shipments. India itself is a big market,” Hoque said.

According to the entrepreneur, the shipment to China has fallen largely because of the lockdowns the world’s second-largest economy had maintained for a longer period to contain Covid-19.

“Trade has not returned to normalcy yet. Besides, global brands usually take delivery from us to China. Local importers in China are yet to start purchasing from Bangladesh.”

Al Mamun Mridha, joint secretary-general of the Bangladesh China Chamber of Commerce & Industry, said rules and regulations governing the export of some products to China have changed, which affected the exports of items such as eel fish.

“We hope exports of the items will increase in the second half of 2023.”

Mirdha said there is no hurdle for garment exports to China. “But the issue is China imports only $10 billion worth of garments. The market is not big.”

Khondaker Golam Moazzem, research director of the Centre for Policy Dialogue, calls the Asian market good for Bangladesh as the country looks to diversify exports.

Chemical, engine parts and agro-based products are exported to some markets in Asia to some extent, he added.

The absence of duty-free market access to all the markets in Asia except for India and China is a challenge, he said.

“Japan and South Korea offer zero-duty entry for some products. But their criteria for local value-addition is high and it is difficult to comply.”

Besides, a number of Bangladesh’s competitors are part of regional trade agreements such as the ASEAN and the Regional Comprehensive Economic Partnership, and they get duty benefits while shipping goods to the region.

“We can’t take advantage since we are not part of the trade pacts. We have to be either part of the regional trade agreements or sign a bilateral trade agreement with major countries to tap our export potential,” Moazzem said.

The duty issue will receive more attention in the coming years as Bangladesh is expected to lose preferential access to advanced markets after its graduation from the group of least-developed countries in 2026.

For example, Bangladesh may face tariffs of around 8-11 per cent in the Japanese market.

“We will fall behind if we don’t have the benefit of duty-free entry,” said Pacific Jeans’ Tanvir.

“We should sign trade agreements to remain competitive after we become a developing country.”

SOURCE – CLICK HERE