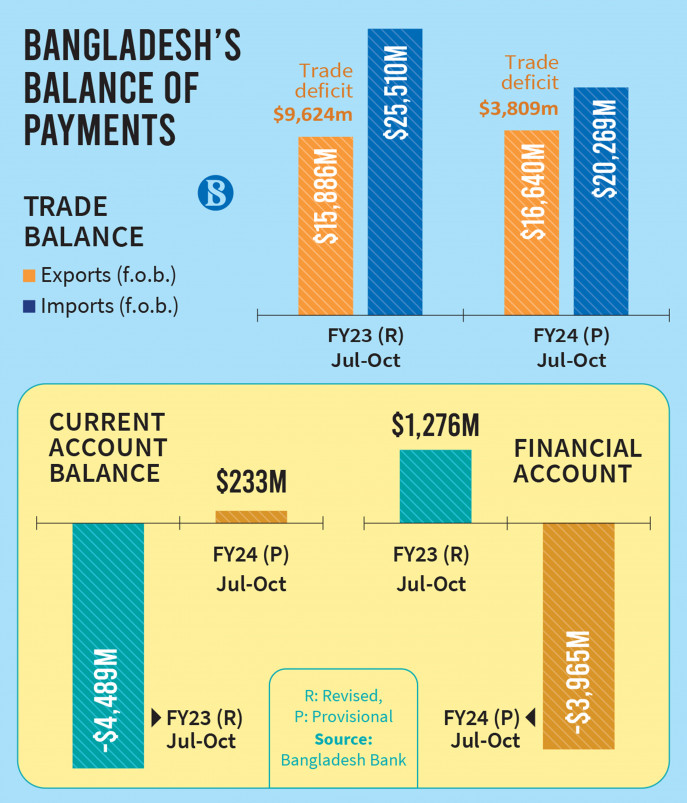

Bangladesh’s current account surplus saw a substantial decline in October, plummeting to only $233 million, a reduction of four-fifths from the previous month. This sharp decrease is attributed to a surge in imports, sluggish export growth, and a negative trend in remittances, according to the Bangladesh Bank. In September, the country had boasted a more robust surplus of $1.2 billion.

Analysts say the notable contraction in the current account surplus raises concerns about its potential impact on the exchange rate and foreign exchange reserves.

The current account, encompassing the balance of trade (exports minus imports of goods), net income from abroad, and net current transfers, holds significant importance as a key component of the broader balance of payments.

Zahid Hussain, former lead economist of the World Bank Dhaka office, said, “Our export growth has decreased compared to earlier. Besides, there has been a negative growth in remittances. Our comfort zone in the balance of payments was the surplus current account balance. Now that too is shrinking.”

A senior official of the central bank said that one of the reasons for the decrease in the current account balance is the increase in imports. Imports have been close to $5 billion every month since July of the new fiscal year. However, imports in October were around $5.5 billion. As a result, it has an impact on trade balance and current account balance.

According to the central bank, export growth in FY 23 was 6.67%. The growth rate fell to 3.61% in the first four months of FY 24. On the other hand, remittance inflow dropped by 4.35% compared to the previous fiscal year.

The current account balance is the primary source of a country to make foreign payments. When a country’s current account balance turns negative, it makes foreign payments from the financial account. If the financial account becomes negative, then payments are made directly from reserves.

Financial account deficit – which comprises foreign direct investment; short-, medium- and long-term loans, and trade credits – compressed slightly in October.

According to the central bank, the financial account deficit stands at $3.97 billion in four months, lowered by $112 million from September. It had a $1.28 billion surplus in the same period last fiscal year.

Zahid Hussain said that although the financial account deficit has decreased slightly, it is not much significant. Trade credit deficit is $3.66 billion. That is, exporters are not bringing their full payment into the country.

“One of the reasons for this is that exporters are getting lower rates for their dollars. Exporters are now getting an official dollar rate of Tk109.75 even though banks buy remittances at Tk123. If the dollar rate is not based on the market, the trade credit deficit may increase,” he said.

According to the Bangladesh Bank, the financial account deficit is widening due to the decrease in various short, medium and long term loans. The repayment amount exceeds the acquisition of new short-term loans. In the first four months of the current fiscal year, repayments were about $900 million more than new loans. On the other hand, medium and long term loans were found to be about 17% less than last fiscal year.

A senior official of the central bank said, “We are getting less foreign loans now. Foreign investment is also not increasing that way. One of the reasons for this is that various international organisations have given us a negative rating. As a result investors are feeling more risk in investing here.”

According to central bank data, the dollar was sold at Tk96 from the reserve in October last year. The dollar was last devalued in November this year to Tk110.25. Due to this devaluation of the currency, the cost of repaying foreign loans has gone up a lot.

Zahid Hussain said, “Our loan availability has reduced. That is, in many cases we want to take a loan but we cannot get it. Lack of confidence is one of the major reasons for getting short term loans.”

Bangladesh’s deficit in trade balance – difference between export and import – also widened further in October, in spite of a significant decrease in imports.

The trade deficit widened to $3.81 billion in the July-October period of FY 24, up from $1.82 billion in July-September, according to the Bangladesh Bank’s data.

However, the trade deficit at the end of July-October of the previous financial year was $9.62 billion. That is, compared to the same period of the previous financial year, the country’s trade deficit has come down a lot.

Overall, the country’s overall balance of payments deficit stood at $3.83 billion at the end of September. That is about $900 million less than the same period in the previous fiscal year mainly due to the decrease in error and omission.

SOURCE: CLICK HERE