Bangladesh is the second largest supplier of ready-made garments to the world, however, Bangladeshi exporters have to compete with suppliers from countries like Vietnam, India, Cambodia, Indonesia and Turkey to maintain its position. At present they export more than the competitors but the prices are comparatively much lower.

According to the data of the World Trade Organization (WTO), the size of the global clothing market last year was $576 billion, out of this, Bangladesh’s market share in the global apparel market has increased to 7.9 percent. Bangladesh supplied garments worth $45 billion to the world market. The two largest markets for apparel supplied from here are the United States and European Union (EU) countries. The official statistics of the destination countries and regions have also revealed that Bangladeshi exporters get the lowest prices for supplied garments.

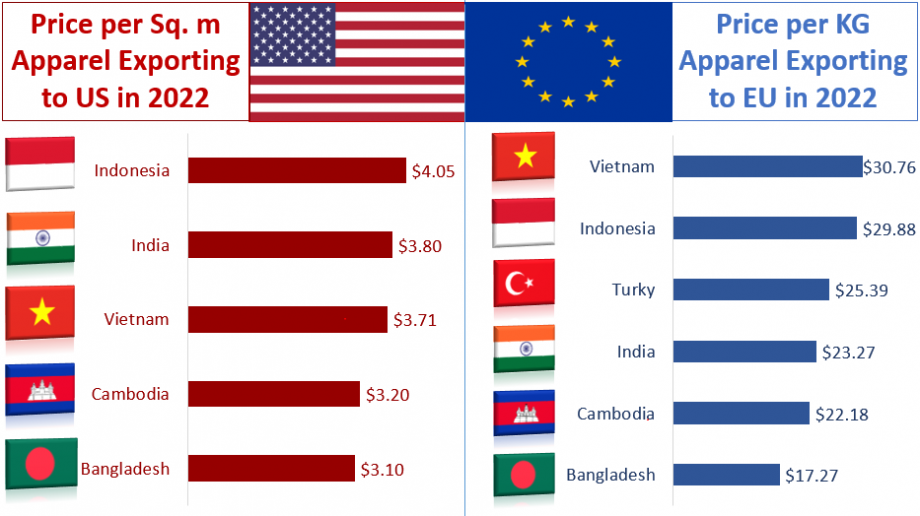

According to the statistics of the Office of Textiles and Apparels (OTEXA) under the US Department of Commerce, Bangladesh is now the third largest supplier to the US market. According to statistics, Vietnam, the second largest supplier country, supplied the United States with $18.24 worth of clothing in 2022. That is why the country’s exporters got an average price of $3.71 per square meter.

On the other hand, in 2022, the value of clothing supplied by Bangladesh to the country was $9.74 billion. Bangladeshi exporters received a price of $3.10 per square meter of garment.

India, the fourth ranked country, exported to the country worth $5.68 billion and received $3.80 per square meter. The fifth supplying country Indonesia, exported worth $5.60 billion and got an average price of $4.05 per square meter while Cambodia, which is in the sixth position, exported worth $4.35 billion and got $3.20 per square meter on an average.

Bangladeshi suppliers have got much lower prices than competitors in EU countries also. China is the top supplier to the market in this region, Bangladesh is in the second position followed by Turkey, India, Vietnam and Cambodia respectively. Last year, the value of apparel supplied by Bangladesh to the EU market was $22.89 billion. According to data from the EU statistical agency Eurostat, Bangladeshi exporters received $17.27 per kilogram of clothing supplied to countries in the region.

Last year, Turkey supplied clothes worth $19.82 billion to the EU. In contrast, the price was $25.39 per kg while Indian exporters supplied garments worth $4.86 billion and the price per kg was $23.27. The value of clothing supplied by Vietnam was $4.57 billion and exporters here got a price of $30.76 per kg. Cambodian exporters received $22.18 per kg.

One of the reasons why Bangladeshi exporters get low prices for clothing are the lack of variety in clothing and the export of relatively low-priced clothing. While the demand for synthetic or manmade fiber garments is increasing globally, Bangladesh is lagging far behind in this.

Mohammad Hatem, Executive President of BKMEA, said, “Although Bangladesh is the second largest exporter of ready-made garments in the world market, it mainly sells comparatively low-priced garments. To improve this situation, industrial owners should diversify their investment.”

“Now the demand of synthetic fiber clothing is increasing in the global market and the price is also high. Therefore, the entrepreneurs of the ready-made garments and textile sector have to invest in the manmade fiber sector and for this the, policy facilities of the government are required,” he added.

Mohammad Ali Khokon, President BTMA said, “Manmade fiber or fabric made of artificial fibers can be used to make high-priced clothing products and earn high export prices. For this, investment should be expanded. For which the policy support of the government is essential.”

However, that situation is starting to change now. Because now we have started doing value added items. Now we are exporting value added products like printed, embroidered, jackets, suits.

Faruque Hassan, President of BGMEA, said, “We are still lagging behind in terms of prices. We have been focusing on exports for a long time. The situation has improved somewhat and will improve further in the coming years. Because now we have started doing value added items and the price will increase every year. Year-on-year statistical analysis reflects our improvement.”

SOURCE: CLICK HERE