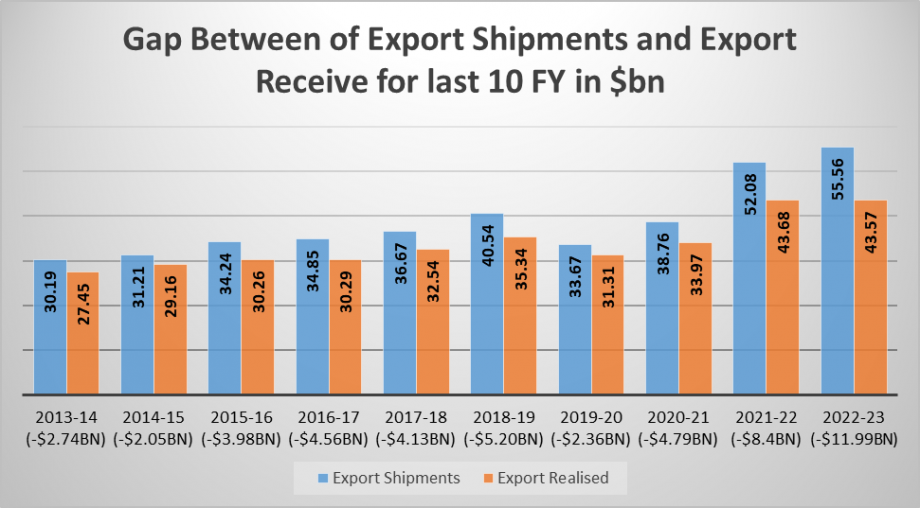

The Export Promotion Bureau (EPB) officially publishes the country’s exports of goods and services. According to their data, in the financial year 2022-23, the export of goods worth $55.56 million. Out of this, Bangladesh Bank has confirmed that the export income of $43.57 billion has come to the country. That means $11.99 billion of exports of that financial year did not come to the country.

In local currency, the amount is 1 lakh 32 thousand 189 crores (1 dollar = 110.25 taka). And $90 million of service export did not come to the country. Such information has emerged in a report published by Bangladesh Bank.

The majority of the country’s exports come from the garment sector, 84 percent. According to EPB, readymade garments exports worth $46.99 billion last financial year. However, Bangladesh Bank says that $36.95 billion came to the country from the export of ready-made garments in the last financial year. That means $10.04 billion worth of garment exports in the last financial year did not arrive in the country until last June.

EPB data also say that in the financial year 2022-23, jute and jute products worth $910 million were exported, but $915 million came into the country. Of the $122 million exports of leather and leather products, $131 million returned to the country. Again, home textile products worth $110 million were exported, but $73 million came to the country.

There is a discrepancy not only in the export of goods but also in the export of services. $7.40 billion came into the country against services exports of $7.49 billion. In other words, $9 million dollars of the service sector did not come to the country.

Bangladesh Bank spokesperson Mezbaul Haque told the media about this, “Bangladesh Bank calculates only the money that comes through the bank. On the other hand, EPB gives statistics by adding various accounts including EPZ, short shipment and discount, etc.” There are differences between Bangladesh Bank and EPB accounts due to various reasons.

However, he said, the tripartite committee is working to find out the root cause of the difference between the two organizations. He also said that the issues will be clear once the report of the committee is received.

In response to another question, Mezbaul Haque said that income from export of goods comes later in many cases. Re-exports also occur.

Siddiqur Rahman, the former president of BGMEA said that such a difference is not reasonable. There is a real need to look into the reason for the miscalculation.

However, BGMEA-Vice President Shahidullah Azim blamed the arrears of export earnings on the delay in payment by buyers. He said, declining demand for goods due to the Russia-Ukraine war is the main reason for buyers not paying on time, leading to over dues.

According to the customs data, overdue export earnings was $80 million in 2022 is the highest figure in the last five years.

According to some bank officials, this discrepancy also may occur due to increase of unrealized export proceeds. Buyers’ payment behavior has changed amid the global economic crisis following the Ukraine war. The trend of deferred payments is on the rise, buyers now prefer to pay after selling 50% to 60% of their goods amid business slowdown and rising inflation.

On the other hand, many exporters are delaying cash payments to take advantage of higher exchange rates amid the rising value of the dollar, which has now become a trend that widens the gap between export shipment prices and realized prices.

SOURCE: CLICK HERE