Exports grew 27% in November compared to October on the back of higher demands for apparels in the West as the festival season has already set in Bangladesh’s major export destinations.

Apparel exports were $4.05 billion in November, 28% higher than October’s $3.16 billion, according to the Export Promotion Bureau (EPB) data released on Monday.

The data of positive export trend came a day after the central bank figures showing a 2.4% decline in remittance inflow in November than the previous month.

November’s overall export earnings of $4.78 billion were, however, 6% less compared to the same period of last year, when exports surged on pent-up demand during the post-Covid recovery.

Apparel makers said despite disruptions from worker unrest and political programmes, they had to ship additional supplies for global buyers and brands to help them build stocks ahead of Thanksgiving Day, Black Friday, Christmas and Boxing Day.

They hope for the trend to continue in coming months as the peak sales season in Europe and American markets that usually run through January.

Talking with The Business Standard, Shafiur Rahman, Country Manager of Dutch brand G-Star Raw, said generally in November every apparel brand enjoyed about 30% of their annual sales, which is the main reason behind the export growth.

He explained that due to Black Friday sales, some stores emptied their shelves and hurried into building fresh stocks with a shorter lead-time.

Shafiur also mentioned that supplies for October might have been partly delivered in November due to disruptions caused by the workers unrest.

Pacific Jeans Managing Director Sayed M Tanvir said in November exporters were under pressure from global buyers to ship goods ahead of Christmas Day.

November exports also indicate that the apparel exports may bounce back to a positive trend seen in the previous year, which is expected, he added.

BGMEA President Faruque Hassan said there were three reasons for lower earnings compared to the same period of last year—- slowdown in global apparel demand, fall in unit price and a disruption in production due to workers unrest in November.

However, the apparel sector sees some positive signs to bounce back in the months ahead as some brands have already cleared their inventories ahead of the peak festival sales, he said.

In December, there are festivals including Christmas and Boxing Day, and this time stores in western countries see good sales, he added.

Most countries stopped hiking interest rates after about 18 months as inflation started going down, the apparel sector leader said, stating the ground for the positive growth trend.

Fuel price and freight costs were also going down globally, which is another indicator of the world coming back in business, the industry leader added.

Though the export industry is facing heightened global pressures on labour rights issues ahead of the national elections, Faruque Hassan believed that the government will be able to handle the situation through holding a free, fair and acceptable election.

He also hoped that their global business partners would not mix up politics with business.

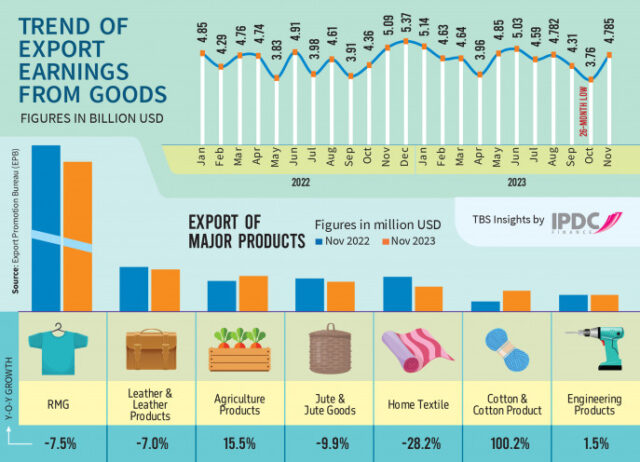

According to EPB, in October overall export earnings were $3.76 billion, which was a 26-month law.

Total exports in November this year were $4.78 billion, 6.05% lower than $5.09 billion in the same period of last fiscal.

Bangladesh Knitwear Manufacturers and Exporters Association (BKMEA) Executive President Mohammad Hatem hoped if the political situation does not worsen, the business may return to a positive trend by next year.

Despite the apparel shipment, the export earnings from all the major sectors witnessed negative growths in the July-November period of FY24.

Among other notable sectors, home textile and leather sectors experienced negative growth.

In the July-November period of FY24, the export earnings from agricultural and jute products also experienced negative growth, along with engineering products, compared with a year-ago period.

SOURCE: CLICK HERE