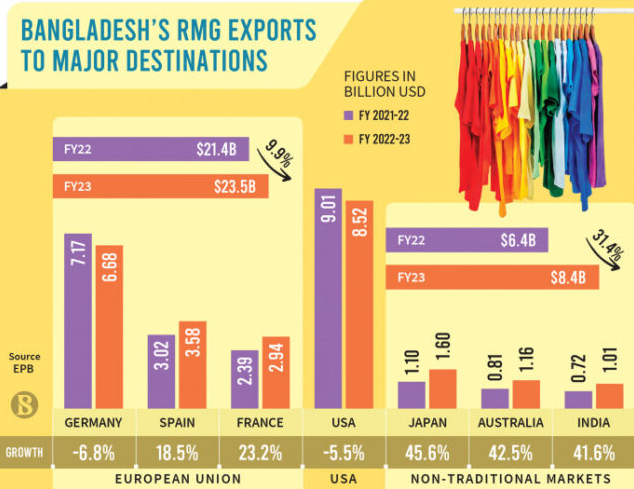

Apparel exports grew by 9.93% year-on-year in the European Union countries to about $23.52 billion, while the earning was $21.40 billion in FY22, according to the Export Promotion Bureau (EPB).

Besides, the UK market also saw 11.78% year-on-year growth to over $5 billion in FY23, while the earning was $4.50 billion in the previous fiscal.

Exporters mentioned that the growth is due to an increase in exports of some high-value products and the high cost of raw materials and freight and forwarding.

This is attributed to the relatively stronger economic performances of these markets compared to their Western counterparts, which are facing challenges due to the ongoing Russia-Ukraine war, they added.

They also mentioned that non-traditional markets are also performing well following the Covid-19 pandemic shock but the overall apparel export volume remained low year-on-year in FY23.

The EPB data show, Bangladesh’s apparel exports to non-traditional markets jumped by 31.38% to $8.37 billion in FY23, which was 17.82% of Bangladesh apparel shipments in FY23.

The Canadian market also grew by 16.55% to $1.54 billion in the last fiscal year, while it was a $1.32 billion market in FY 22.

However, apparel shipments to two major markets – the US and Germany – experienced a decline of 6.81% and 5.51% to $8.51 billion and $ 6.68 billion, respectively.

In FY22, exports to these two countries were $9.01 billion and $7.16 billion respectively.

The EPB data further show apparel export in Japan grew by 45.62% to about $1.60 billion, while the Australian market grew by 42.48% to $1.15 billion in FY23.

Apparel exports to India and South Korea have recorded 41.58% and 22.45% growth to $1.01 billion and $538 million respectively, in the July-June period of FY23.

Also, RMG shipments to China registered a growth of 30.32% to about $290 million.

Faruque Hassan, president of the Bangladesh Garment Manufacturers and Exporters Association said Bangladesh apparel exports enjoyed this growth thanks to some high-value products.

He also mentioned that exports to markets, such as Japan, Korea, India are contributing a lot to the export growth in and non-traditional markets.

Faruque Hassan sought government policy support for further diversification of apparel goods, particularly non-cotton or man-made fibre items, as they are now dominating global markets.

The BGMEA president, however, expressed concerns about a potential decline in Bangladesh’s apparel exports in the coming months, as most factories are operating below their full capacity due to low order volumes.

Echoing a similar view, Shahidullah Azim, vice president of the trade association, said the industry is facing an order shortage to feed its installed capacity.

Due to slow orders, some large factories are scheduled to reopen by 15-16 July after the vacation of Eid Ul Adha, he further said.

Most factories are currently operating at around 30% lower capacity, he said, highlighting that despite increases in utility prices, the shortage of gas and electricity supplies has also resulted in higher apparel production costs.

He said Bangladesh may not continue to grow in the coming months as most factories are facing order shortages.

On the other hand, some buyers are also cancelling orders or imposing up to a 25% discount, which is making the situation tougher for apparel exporters, he added.

Bangladesh’s overall apparel export grew by 10.27% year-on-year to $46.99 billion in FY23, while the earning was $42.61 billion in FY22.

The apparel sector’s export income contributed 84.59% to the country’s total export earnings worth $55.55 billion in the just-concluded fiscal year of FY23, according to EPB data.

SOURCE: CLICK HERE