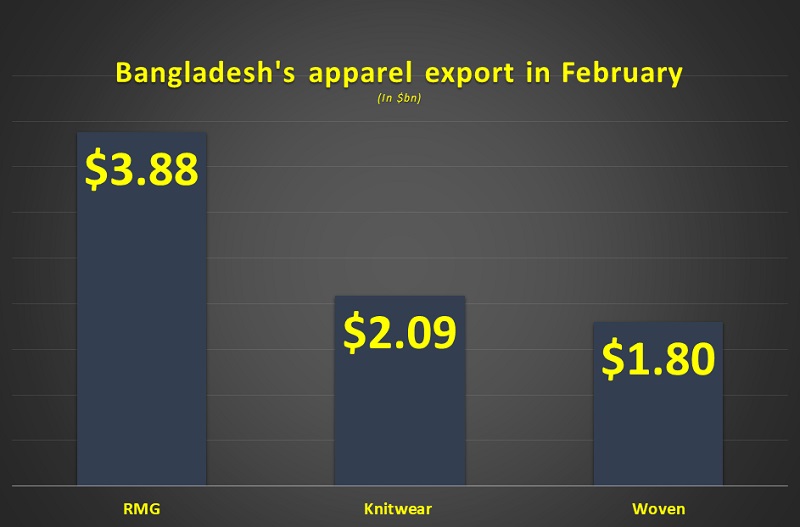

Bangladesh’s readymade garment (RMG) exports earned $3.94 billion with a 12.31% year-on-year growth in the single month of February, according to data published by the Export Promotion Bureau (EPB).

Among the RMG exports, both knitwear and woven apparel witnessed export witnessed significant growth. In February knitwear segment witnessed a 16.94% growth and earned $2.09 billion. While the woven export earning saw a growth of 7.45% and earned $1.80 billion.

Analyzing the EPB data in the July-February period of FY2022-23, the sector witnessed a 14.06% growth and earned $31.36 billion in the first eight months of the ongoing fiscal year.

In the July-February period, knitwear export earned $17.06 billion and witnessed a 13.21% growth. While the woven sector earned $14.30 billion and witnessed a 15.08% growth in the July-February period of FY2022-23.

Although industry leaders have opined a cautious approach to this growth.

Mohammad Kamal Uddin, Chairman, Standing Committee on Trade Fair, BGMEA & Managing Director, Torque Fashions Ltd. said, “Up to February, our apparel export volume decreased a bit but export earning value has increased. In the global turbulent scenario, we are seeing a depression in the work orders. And we will see a down growth in March due to this.”

“Most of our apparel manufacturers are saying that they are witnessing 20 to 30% fewer orders.”

The leader added that, Bangladesh’s apex body, Bangladesh Garment Manufacturers and Exporters Association (BGMEA) is working relentlessly to brand ‘Made in Bangladesh’ worldwide. At the same time with product diversification. He added, “This value-added product export effort was reflected in the exports. Even though the volume decreased – whereas the export value has gone up significantly.”

“Due to the Russia-Ukraine war, our electricity and gas prices have gone up dramatically. Which steeply increased our production cost. Despite these hurdles, entrepreneurs are keeping their factories open 8 hours a day and trying to catch more orders to survive.”

“To defy these extreme challenges, I think like before, the government should provide us some support.”

As a way out, BGMEA leader stressed that the apex body is focusing on man-made fiber (MMF) based apparel manufacturing.

“We are working really closely with Indian MMF manufacturers. We have already done a road march there. India is a good sourcing hub for us as it is near home and gives us cost and lead-time advantage.”

“This transformation will take some time – as it involves a big investment in technology and process.”

“After the pandemic, the apparel value chain has transformed considerably. Small quantity orders have increased. At the same time, sourcing hubs also shifted to near destinations for those small quantity orders. Besides the usual big sourcing regions, nearshoring or even we are seeing small capacity factories in Europe sprung up in recent years to cater the small quantity orders.”

SOURCE – CLICK HERE